Study

IT’S TIME TO EXPLORE

Oxford is an ideal student city. Close to London and well connected but also bursting with things to do, see and experience, you'll enjoy the best of both worlds.

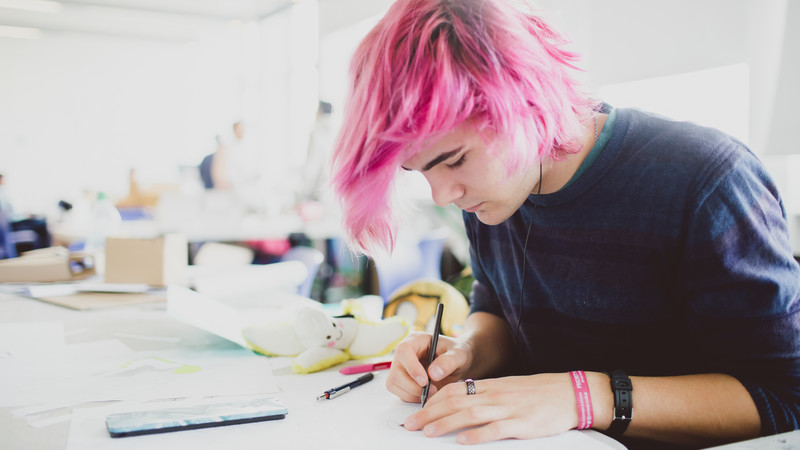

Deciding where, when and what to study at university are three big decisions to make.

But making them doesn't have to be scary or intimidating. Whether you're thinking about applying for uni as an undergraduate, postgraduate or international student, all the information you need to make the right choice for you is here – from how to choose a course that meets your needs, to finding student accommodation that fits your budget.

Information on tuition fees for new and returning students at Oxford Brookes University.

Whether you are a new or returning student, there are a variety of funding options available to help finance your studies.